The Hidden Tax on Growth: Why Mark-to-Market Volatility is Destroying Your P&L

You run a successful, growing business. You use forward contracts to confidently lock in your margin on foreign currency sales or purchases. Yet, every quarter, your CFO sees unexpected swings in the Profit and Loss (P&L) statement. This isn’t poor performance; it’s Mark-to-Market (MtM) volatility. It’s the hidden tax that IFRS 9 levies on companies that hedge their risk without proper accounting procedures.

1. The Core Misunderstanding: Forward Contracts and P&L Swings

Many Financial Controllers believe that executing an FX Forward Contract automatically eliminates foreign exchange risk. They are right from a cash flow perspective, but dangerously wrong from an accounting perspective.

Under IFRS 9, derivatives must be recorded at their Fair Value (IFRS 13), and changes in this value (MtM) must be immediately recognized in the P&L statement unless you formally apply Hedge Accounting. If you don’t:

- The volatility of the forward contract hits your P&L immediately.

- The offset (the gain or loss on the underlying transaction) is recognized later.

This timing mismatch creates volatility. You have successfully hedged your cash flow, but your accounting records make your profitable business look unstable to investors, banks, and internal stakeholders.

2. IFRS 9 Hedge Accounting: The P&L Stabilization Tool

The solution is clear: Hedge Accounting. This is IFRS 9’s specific framework designed to align the accounting recognition of the hedging instrument (the forward contract) with the hedged item (the future cash flow or firm commitment). The goal is to defer the derivative’s MtM gain or loss, sending it temporarily to the Other Comprehensive Income (OCI) account.

This is the difference between being a Risk Traditionalist and becoming a Risk Strategist. By stabilizing the P&L, you communicate the true economics of your hedging strategy: predictable margins and controlled risk.

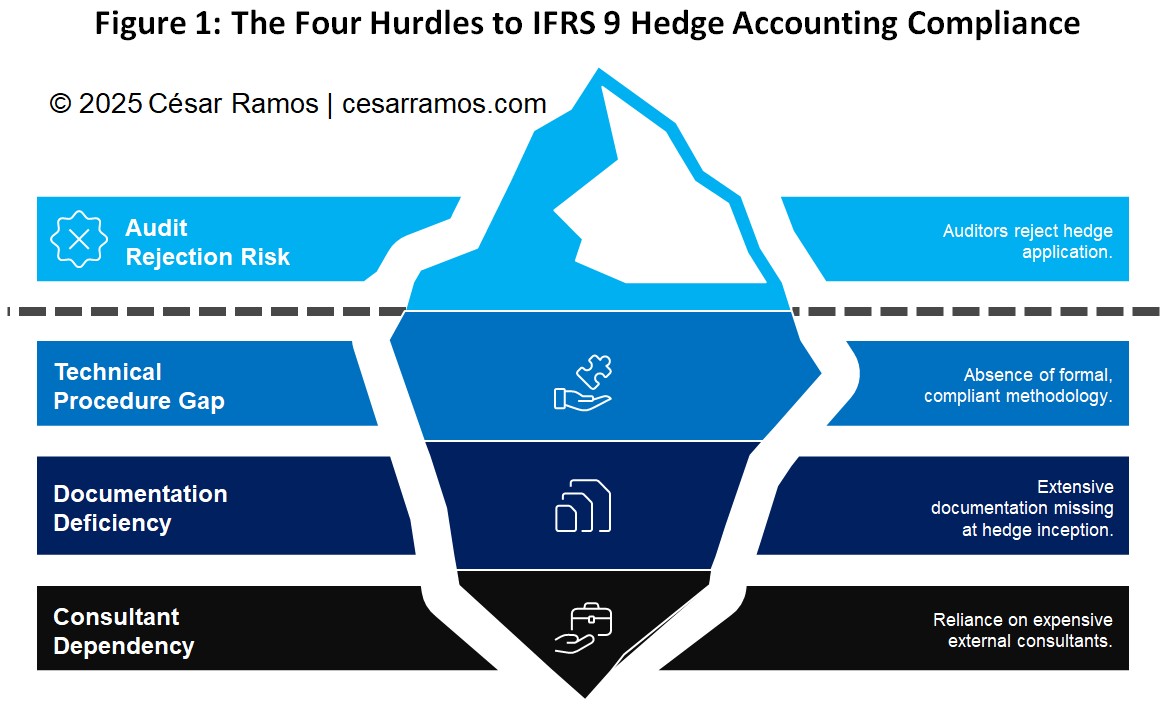

Figure 1: The Four Hurdles to IFRS 9 Hedge Accounting Compliance

Source & Methodology: César Ramos

3. Why Most SMEs Fail to Implement Hedge Accounting

The concept is simple; the execution is not. Companies often fail to implement Hedge Accounting due to three main hurdles:

- Lack of Technical Procedure: You need a formal, compliant methodology, often based on the Spot-to-Spot Method, to split the forward contract into its different components (e.g., the spot and the forward components).

- Missing Documentation: IFRS 9 requires extensive, formal documentation at inception of the hedge. This includes the Hedge Designation Memo, Fair Value Procedures, and Effectiveness Tests. Without this audit-proof paper trail, your auditors will reject your application.

- Reliance on Expensive Consultants: Historically, only large corporations with dedicated Treasury departments or expensive external consultants could afford to maintain this level of compliance.

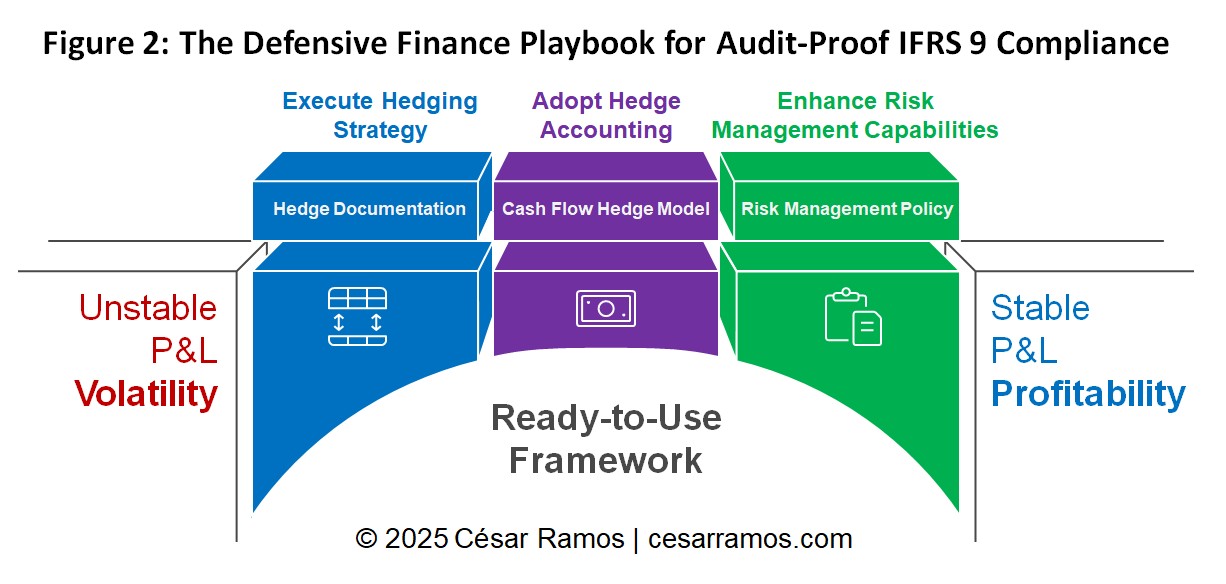

Figure 2: The Defensive Finance Playbook for Audit-Proof IFRS 9 Compliance

Source & Methodology: César Ramos Consulting

The key to P&L stability is standardized documentation.

Your team knows finance; what they often lack is the specific procedural playbook used by Big Four auditors and senior treasurers to create a defensive file.

The solution requires a ready-to-use framework that provides all the models, journal entries, and documentation templates you need to ensure your forward contracts stabilize your P&L, not destroy it.

Conclusion: Turn Compliance into Clarity

Don’t let MtM volatility mask the profitability of your core business. Achieving IFRS 9 Hedge Accounting compliance is not just a regulatory hurdle; it’s a financial necessity that provides clear, predictable financial reporting.

The expertise is available, and the documentation requirements are standardized. The difference between chaotic P&L swings and financial clarity is often just a matter of having the right set of IFRS 9-compliant procedures and models in place.